Bonds (Fixed Income)

Discover the foundational role of bonds in investment portfolios, offering predictability and a reliable source of passive income. Learn how these debt instruments can fortify your financial future.

Bonds are essentially loans made by an investor to a borrower (typically a corporation or government). When you buy a bond, you are lending money to the issuer, who, in return, promises to pay you back the principal amount (face value) on a specific date (maturity date) and usually pays you regular interest payments along the way. These interest payments are known as coupon payments, and they form the basis of passive income for bondholders.

Bonds are a cornerstone of stable investing, providing consistent income and capital preservation.

Demystifying Bonds: The Core Concepts

Think of a bond as an I.O.U. certificate. Governments issue bonds to fund public projects like infrastructure or defense, while corporations issue them to finance expansions, research, or operational needs. Unlike stocks, which represent ownership in a company, bonds represent debt. This makes them generally less volatile than stocks, offering a different risk-reward profile.

Key characteristics of a bond include its face value (the amount repaid at maturity), coupon rate (the interest rate paid), maturity date (when the principal is repaid), and issuer (who borrowed the money). Understanding these elements is crucial to evaluating a bond's potential return and risk.

- Fixed Income: Bonds typically provide predictable income streams through regular interest payments.

- Capital Preservation: At maturity, the investor usually receives their initial investment back, making bonds attractive for preserving capital.

- Lower Volatility: Generally, bonds are less susceptible to wild price swings compared to stocks.

Why Bonds Are a Pillar of Prudent Investing

Consistent Income Stream

One of the primary attractions of bonds is their ability to provide a predictable and steady stream of income. The fixed interest payments (coupons) can be a reliable source of passive income, making them ideal for retirees or those seeking consistent cash flow from their investments.

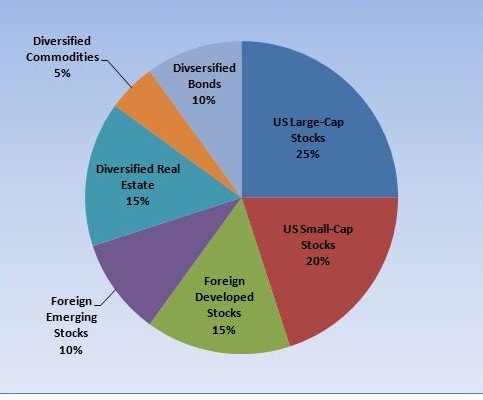

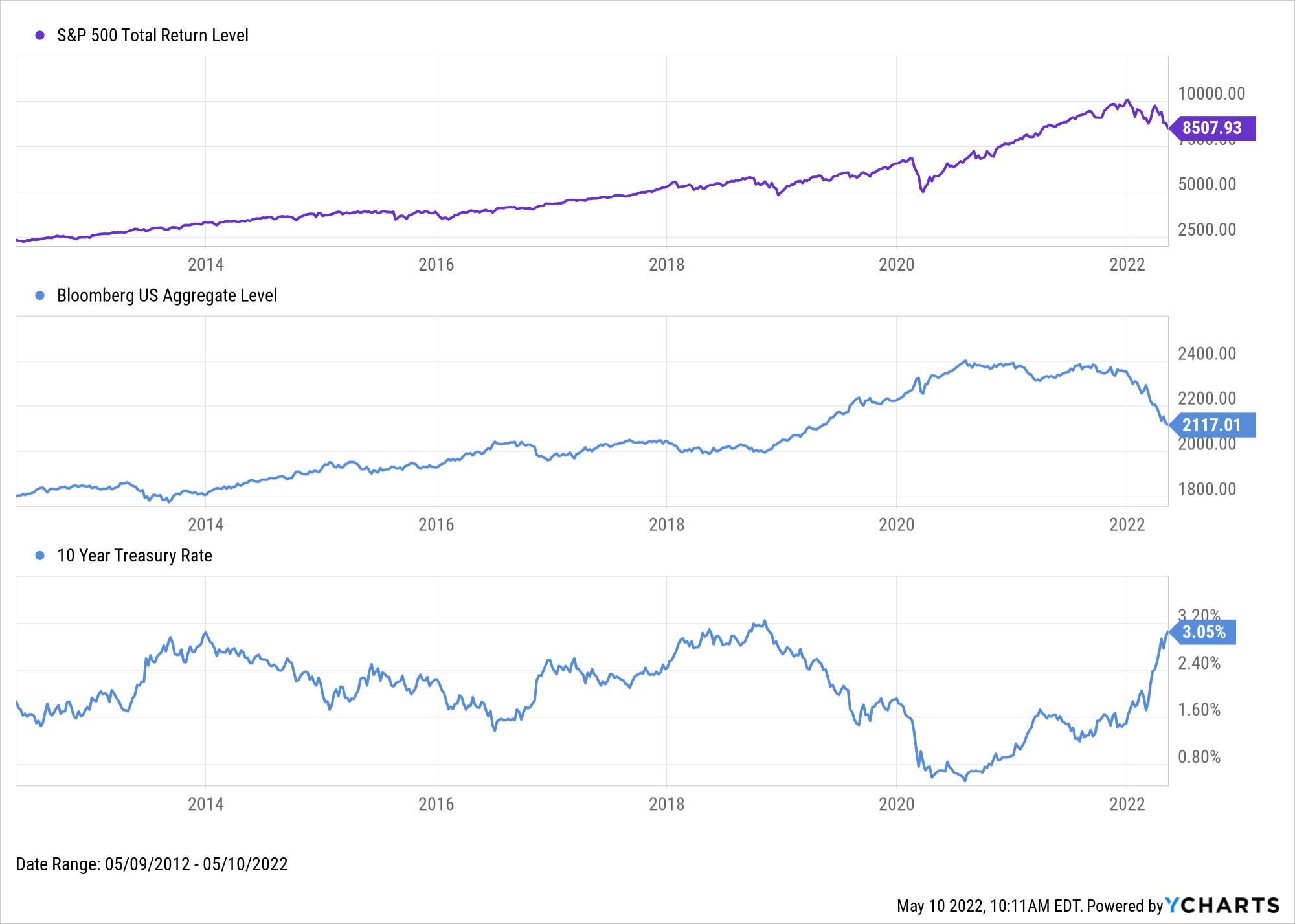

Risk Mitigation & Diversification

Bonds generally have a low correlation with stocks, meaning they often perform differently under varying market conditions. Adding bonds to a stock-heavy portfolio can help reduce overall portfolio volatility and risk, providing a cushion during equity market downturns.

Capital Preservation

For investors prioritizing the safety of their principal, bonds are often a preferred choice. When held to maturity, the issuer is obligated to return the initial investment, making them a relatively safe haven for capital compared to more volatile asset classes.

Navigating the Diverse World of Bonds

The bond market offers a variety of instruments, each with its own characteristics, risks, and potential returns. Understanding the different types helps in making informed investment decisions.

Government Bonds

Issued by national governments (e.g., U.S. Treasuries, UK Gilts), these are generally considered the safest bonds due to the backing of the issuing government's taxing power. They are often used as a benchmark for other interest rates.

Corporate Bonds

Issued by companies to raise capital, these bonds carry a higher risk than government bonds but typically offer higher interest rates to compensate investors for that increased risk. Their creditworthiness varies depending on the issuing company's financial health.

Municipal Bonds ("Munis")

Issued by state and local governments to finance public projects, municipal bonds often offer tax-exempt interest income, making them particularly attractive to investors in higher tax brackets. Their safety depends on the financial stability of the issuing municipality.

Building Passive Income Through Bond Investments

While direct bond purchases are an option, several accessible investment vehicles allow you to generate passive income from bonds without the need for extensive market knowledge or direct management.

Bond ETFs and Mutual Funds

Exchange Traded Funds (ETFs) and mutual funds that invest in bonds provide instant diversification across a basket of bonds. This allows investors to gain exposure to various bond types, maturities, and issuers with a single investment, simplifying the process of earning passive income from bond interest payments.

Managed Bond Portfolios

For a truly hands-off approach, professional financial managers can construct and manage a bond portfolio on your behalf. These managed accounts aim to optimize yield and mitigate risk according to your financial goals, providing a seamless way to generate consistent passive income from bonds.

Secure Your Future with Bonds through AssetFusionX

At AssetFusionX, we emphasize the importance of a balanced portfolio, and bonds are a crucial component for achieving stability and generating reliable passive income. We simplify your access to the bond market, ensuring your investments are secure and fruitful.

Optimized Bond Portfolio Creation

AssetFusionX leverages advanced analytics and expert insights to identify high-quality bonds and bond funds that align with your risk tolerance and income goals. We construct diversified bond portfolios designed to provide steady returns and act as a buffer against market fluctuations, ensuring a reliable stream of passive income.

Effortless Passive Income Generation

With AssetFusionX, you don't need to become a bond market expert. Our platform handles the intricacies of bond selection, purchase, and management. We focus on delivering consistent interest payments directly to you, making it simple to achieve your passive income aspirations through the stability of bonds.