Forex Trading

The world's most liquid and fast-moving market. With AssetFusionX, access professional-grade forex strategies and global currency exposure—without needing to become a trader yourself.

Introduction?

Forex (foreign exchange) is the marketplace for buying and selling currencies. With over $7 trillion traded daily, it's the most liquid market in the world—operating 24 hours a day, five days a week.

From USD to EUR, JPY to GBP, traders speculate on exchange rate movements between global currencies, influenced by macroeconomic trends, interest rates, political shifts, and market sentiment.

Forex, short for Foreign Exchange, is the global decentralized or over-the-counter (OTC) market for the trading of currencies. This includes all aspects of buying, selling and exchanging currencies at current or determined prices. It is, by far, the largest financial market in the world, with an average daily trading volume exceeding $7 trillion. To put that into perspective, it dwarfs the stock market, bond market, and every other financial market combined.

What Exactly is Forex?

Imagine you're traveling from the United States to Europe. You need Euros, so you exchange your US Dollars at a bank or currency exchange. When you do this, you're essentially participating in the foreign exchange market. Forex trading, however, takes this concept to a speculative level. Traders aim to profit from the fluctuating values of different currencies against each other.

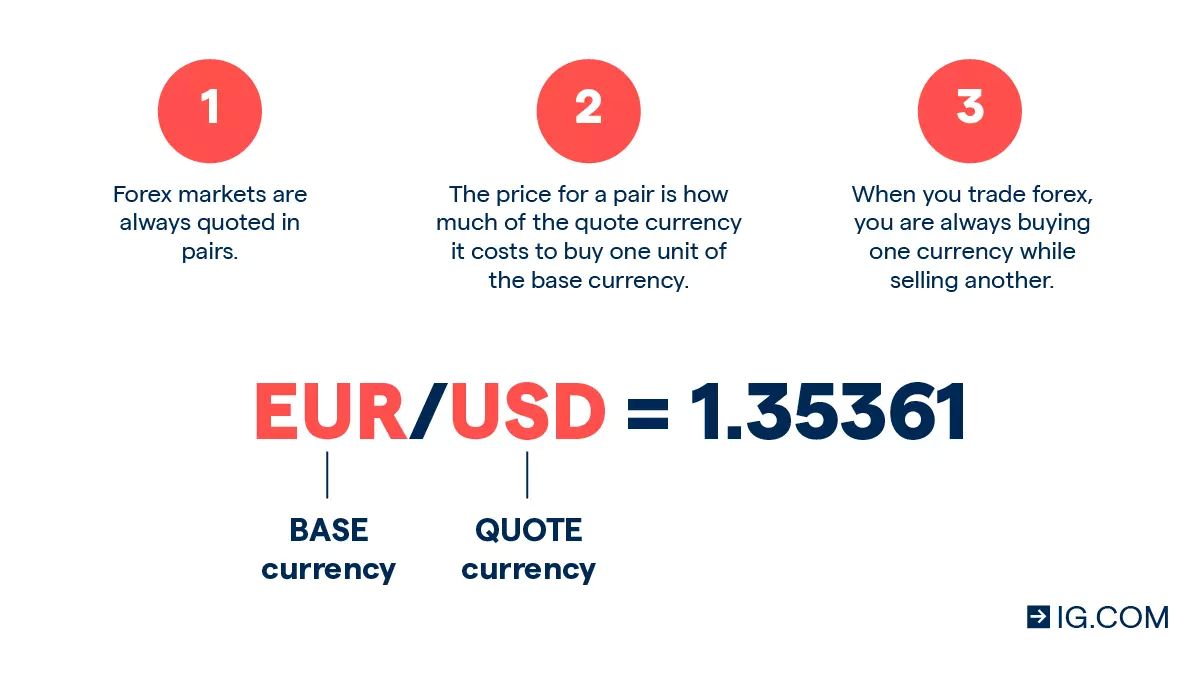

Currencies are always traded in pairs, like EUR/USD (Euro against US Dollar) or GBP/JPY (British Pound against Japanese Yen). When you buy EUR/USD, you are simultaneously buying Euros and selling US Dollars, anticipating that the Euro will strengthen against the Dollar. Conversely, if you sell EUR/USD, you expect the Euro to weaken against the Dollar.

- Decentralized Market: Unlike stocks that trade on exchanges, Forex operates over-the-counter (OTC) globally.

- 24/5 Accessibility: The market is open virtually around the clock, from Monday morning in Asia to Friday afternoon in New York.

- High Liquidity: Its immense size means you can buy and sell major currencies with ease, with minimal impact on prices.

Why Consider Forex Trading for Your Portfolio?

24/5 Market Access

The Forex market operates continuously from Monday to Friday, spanning major financial centers worldwide. This means you can react to news and events as they happen, regardless of your time zone, offering unparalleled flexibility compared to traditional markets with fixed hours.

Unmatched Liquidity

With trillions of dollars exchanged daily, Forex is the most liquid financial market. This ensures that trades can be executed quickly and efficiently, often with very tight spreads (the difference between buying and selling prices), making it easier to enter and exit positions.

Leverage Opportunities

Forex trading often involves leverage, allowing traders to control a large position with a relatively small amount of capital. While this can magnify potential profits, it's crucial to understand that it also amplifies potential losses. Used wisely, leverage can be a powerful tool for optimizing returns.

Understanding the Drivers of Currency Movement

Currency prices are constantly shifting, influenced by a complex interplay of economic, political, and social factors. Understanding these drivers is key to navigating the Forex market successfully.

Economic Indicators

Interest rates, inflation, GDP growth, employment figures, and trade balances all provide crucial insights into a country's economic health, directly impacting its currency's value. Stronger economic data typically leads to currency appreciation.

Geopolitical Events

Political stability, elections, international relations, and major global events can trigger significant currency volatility. Uncertainty often leads investors to seek safer haven currencies.

Market Sentiment & Speculation

The collective mood of traders, influenced by news, rumors, and technical analysis, can create powerful trends. Speculative trading, while risky, also contributes significantly to market movements.

Achieving Passive Income through Forex

While Forex trading often implies active involvement, there are compelling strategies that allow you to generate passive income from this vibrant market. This opens up opportunities for individuals who may not have the time for day-to-day trading but still want to benefit from currency movements.

Automated Trading Systems (EAs)

Expert Advisors (EAs) or trading robots are software programs that automatically execute trades based on pre-programmed rules and strategies. Once configured, they can operate 24/5, identifying and acting on trading opportunities without constant manual intervention. This allows for a truly hands-off approach to trading.

Managed Forex Accounts

For those who prefer professional oversight, managed Forex accounts allow you to entrust your capital to experienced fund managers. These managers trade on your behalf, aiming to generate returns while you retain ownership of your funds. This option provides a more passive investment route, leveraging expert knowledge.

Your Forex Journey with AssetFusionX

At AssetFusionX, we understand the allure and potential of the Forex market. We bridge the gap between complex global finance and your passive income goals.

You don't have to learn candlesticks, analyze economic calendars, or stay up at 2am to catch Tokyo market volatility. AssetFusionX simplifies forex investing by giving you exposure to professional currency strategies, without the stress of manual trading.

Our engine monitors key currency pairs, allocates capital across balanced forex models, and manages risk dynamically—so your money moves with global momentum.

Expertly Curated Strategies

Leverage our deep understanding of the Forex market. AssetFusionX employs sophisticated algorithms and expert analysis to identify optimal trading opportunities, ensuring your investments are guided by precision and foresight. Whether it's automated trading or carefully managed portfolios, we strive to maximize your passive income potential in the currency market.

Seamless & Secure Investment

With AssetFusionX, investing in Forex is straightforward and secure. Our platform simplifies the process, allowing you to allocate funds to Forex strategies with confidence, knowing that your capital is handled with the utmost care and protected by robust security measures. We handle the complexities, so you can focus on enjoying your passive earnings.

FAQs About Forex at AssetFusionX

Do I need to understand currency trading?

Not at all. Our system handles everything. You don't need charts, brokers, or economic knowledge. We do the work. You earn the result.

What makes forex different from stocks?

Forex focuses on currency value relationships instead of business ownership. It's faster, more liquid, and moves on different forces—often complementing your stock portfolio.

How often is my forex investment adjusted?

Our systems evaluate positions daily and make adjustments based on volatility, news cycles, and macro changes.