Unlocking Potential: Navigating the World of Derivatives for Advanced Strategies

Explore the sophisticated realm of derivatives, financial contracts whose value is derived from an underlying asset. Discover how these versatile instruments can be used for hedging, speculation, and amplifying investment returns.

Derivatives offer powerful tools to manage risk and enhance returns, but they require a clear understanding of their mechanics and underlying assets.

Derivatives: Contracts Shaped by Underlying Assets

At their core, derivatives are financial contracts that derive their value from an underlying asset or group of assets. This underlying asset can be almost anything: stocks, bonds, commodities, currencies, interest rates, or even market indices. Instead of directly buying or selling the asset itself, you're trading a contract that represents its future value or price movement.

The complexity of derivatives lies in their varied structures and uses. They are primarily employed for two broad purposes: hedging, which involves mitigating risk by offsetting potential losses in an existing investment, and speculation, where traders aim to profit from anticipating future price movements of the underlying asset. Their flexibility makes them powerful tools in advanced financial strategies.

- Value from Underlying: Their price is directly linked to an external asset, not inherent value.

- Risk Management: Used to protect existing investments from adverse price changes.

- Leverage Potential: Can control a large position with a relatively small initial outlay.

Key Types of Derivatives in Financial Markets

The world of derivatives is diverse, with several common types catering to different strategic needs. Each has unique characteristics and applications.

Futures Contracts

A futures contract is an agreement to buy or sell an asset at a predetermined price on a specified future date. These are standardized and traded on exchanges, making them highly liquid. They are commonly used for commodities like oil and gold, as well as currencies and financial indices, for both hedging and speculation.

Options Contracts

An options contract gives the holder the *right*, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a certain date. This 'right, not obligation' feature provides flexibility and limits risk to the premium paid, but potential returns can be significant.

Swaps

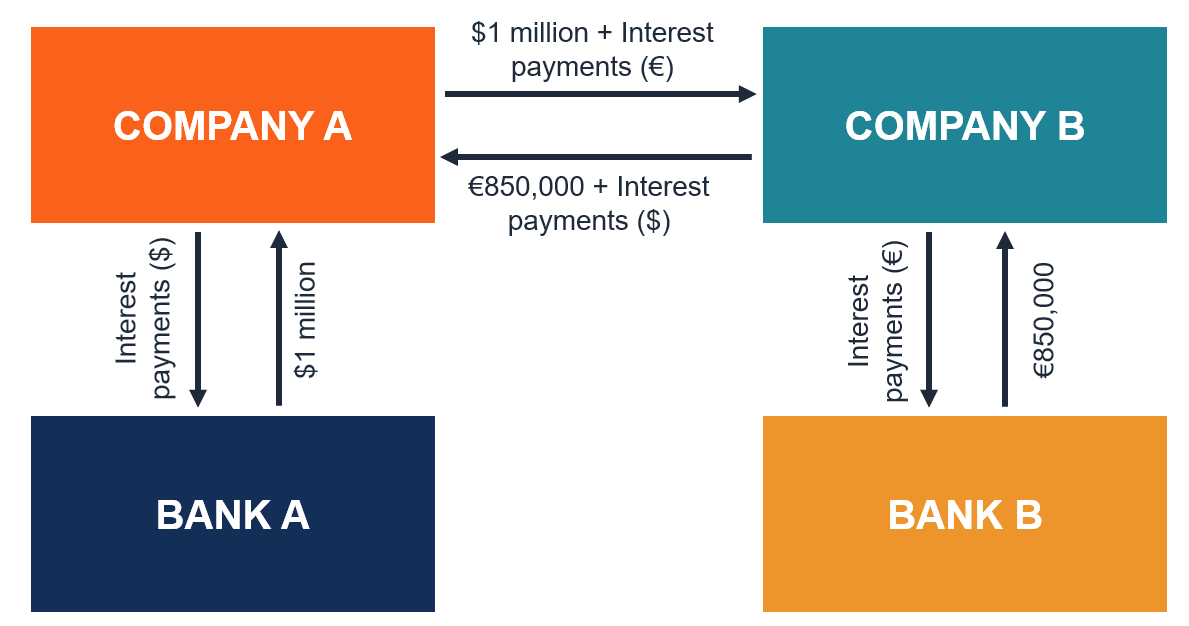

A swap is a derivative contract where two parties exchange financial instruments or cash flows. The most common type is an interest rate swap, where one party exchanges a fixed interest rate payment for a floating interest rate payment. Swaps are primarily used by institutional investors to manage interest rate or currency risks.

Forwards

Similar to futures, a forward contract is a customized agreement between two parties to buy or sell an asset at a specified price on a future date. Unlike futures, forwards are over-the-counter (OTC) agreements, meaning they are not traded on an exchange, offering greater customization but also higher counterparty risk.

Strategic Applications of Derivatives

Beyond their complexity, derivatives serve crucial roles in modern finance, enabling sophisticated strategies for risk management and profit generation.

Hedging Against Risk

One of the most fundamental uses of derivatives is hedging. For instance, a farmer can use futures contracts to lock in a price for their crop, protecting against a future price drop. Similarly, a company can hedge against currency fluctuations using currency options or forwards.

Speculation and Amplified Returns

Derivatives also attract speculators who aim to profit from anticipated price movements. Due to the inherent leverage, a small price change in the underlying asset can lead to a magnified profit or loss in the derivative contract. This potential for amplified returns makes them appealing for aggressive growth strategies.

Arbitrage Opportunities

Skilled traders use derivatives to exploit minor price discrepancies between different markets or financial instruments. By simultaneously buying and selling related assets, they can lock in risk-free profits from these temporary inefficiencies, contributing to market efficiency.

Derivatives for Advanced Passive Income Strategies

While derivatives are often associated with active trading, certain strategies can be employed to generate passive income, albeit with a higher level of sophistication and risk management.

Covered Call Strategies

For investors holding a portfolio of stocks, selling "covered call" options can be a passive income strategy. You sell the right for someone to buy your shares at a certain price, receiving a premium for doing so. If the stock price stays below that level, you keep the premium and your shares, generating income.

Automated Derivative Trading

Advanced algorithmic trading systems can be deployed to execute complex derivative strategies automatically. These systems can identify and act on opportunities across futures, options, and other derivative markets, potentially generating passive returns through sophisticated, high-frequency trading or pre-programmed strategies.

Harnessing Derivative Potential with AssetFusionX

At AssetFusionX, we provide pathways to integrate sophisticated derivative strategies into your passive income goals. We aim to demystify these powerful instruments and apply them strategically for your benefit.

Sophisticated Strategy Implementation

AssetFusionX offers access to advanced investment strategies that strategically incorporate derivatives. Our expert team and automated systems can implement complex hedging and income-generating techniques, allowing you to benefit from the efficiency and leverage of derivatives without requiring deep personal expertise in these markets.

Managed Exposure to Advanced Markets

Understanding and trading derivatives can be challenging. AssetFusionX simplifies this by providing professionally managed derivative exposure. We assess market conditions, manage associated risks, and execute strategies designed to align with your passive income goals, opening up new avenues for potential returns in your investment portfolio.