Commodities

Explore the fundamental building blocks of the global economy and discover how investing in commodities can diversify your portfolio and offer unique opportunities for growth

Commodities are raw materials or primary agricultural products that can be bought and sold, such as oil, gold, silver, grains, and livestock. They are the essential inputs for virtually every product and service we consume. Unlike manufactured goods, commodities are standardized and interchangeable, meaning a barrel of crude oil from Saudi Arabia is essentially the same as a barrel from Texas, making them ideal for global trading.

From the food on our tables to the energy that powers our world, commodities are everywhere.

Understanding the Essence of Commodities

Commodities are broadly categorized into two main groups: hard commodities and soft commodities. Hard commodities are natural resources that must be mined or extracted, such as gold, oil, and natural gas. They are finite and often subject to geopolitical influences and supply chain disruptions.

Soft commodities, on the other hand, are agricultural products or livestock, like wheat, corn, coffee, sugar, and cattle. Their prices are heavily influenced by weather patterns, crop yields, and global demand. Both types of commodities play a vital role in global trade and investment.

- Tangible Assets: Unlike stocks or bonds, commodities are physical goods with intrinsic value.

- Global Market: Traded worldwide on exchanges, providing continuous opportunities.

- Inflation Hedge: Historically, commodities can offer protection against rising inflation.

The Allure of Commodities in Your Portfolio

Portfolio Diversification

Commodities often move independently of traditional financial assets like stocks and bonds. This low correlation makes them an excellent tool for diversifying your investment portfolio, potentially reducing overall risk and enhancing returns, especially during periods of market volatility.

Inflation Hedge

When inflation rises, the cost of raw materials typically increases, which in turn drives up commodity prices. This makes commodities a valuable hedge against inflation, helping to preserve your purchasing power when the value of fiat currencies might be eroding.

Demand-Supply Dynamics

Commodity prices are fundamentally driven by global supply and demand. Factors like population growth, industrialization, technological advancements, and geopolitical events can significantly impact prices, creating opportunities for those who understand these dynamics.

Exploring Key Commodity Categories

The commodities market is vast and varied, offering exposure to different sectors of the global economy. Here are some of the most commonly traded categories:

Energy Commodities

Crude oil, natural gas, gasoline, and heating oil are essential for transportation, electricity generation, and industrial production. Their prices are volatile, reacting to global supply disruptions, political tensions, and economic growth forecasts.

Precious Metals

Gold, silver, platinum, and palladium are often considered "safe-haven" assets during times of economic uncertainty or inflation. Gold, in particular, has a long history as a store of value and a hedge against currency devaluation.

Agricultural Commodities

Wheat, corn, soybeans, coffee, sugar, and cotton are vital for food production and various industries. Prices are influenced by weather, crop yields, government policies, and global demand for food and biofuels.

Generating Passive Income from Commodities

While direct commodity trading can be complex, there are accessible avenues to gain passive exposure and potentially generate income from these essential assets without deep market expertise.

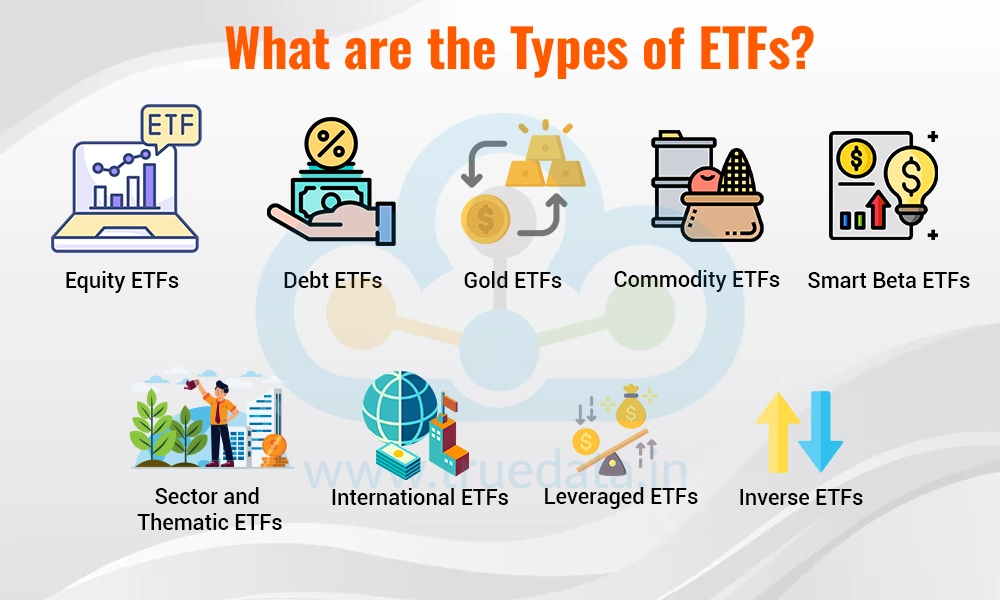

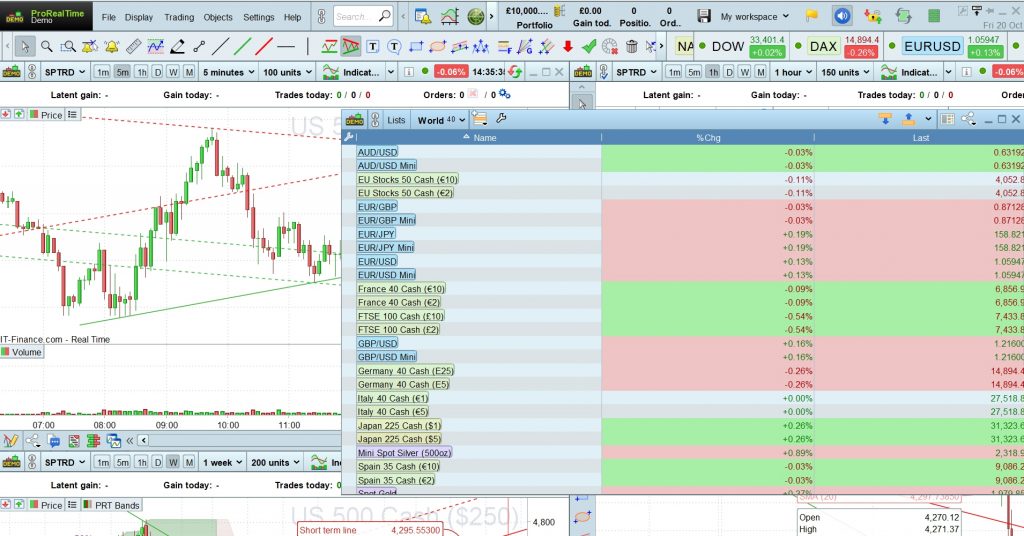

Commodity ETFs and ETNs

Exchange Traded Funds (ETFs) and Exchange Traded Notes (ETNs) offer a convenient way to invest in a basket of commodities or a single commodity without directly owning the physical asset. These funds are traded on stock exchanges and track the performance of specific commodity indices or prices, providing diversification and liquidity.

Commodity-Related Stocks

Investing in companies involved in the production, processing, or transportation of commodities can also offer exposure. For example, shares in oil companies, mining firms, or agricultural businesses often correlate with the performance of their underlying commodities, providing an indirect way to benefit from commodity price movements.

Navigating the Commodity Markets with AssetFusionX

At AssetFusionX, we recognize the unique advantages commodities can bring to a well-rounded investment portfolio. We simplify access to this often-complex market, helping you harness its potential for passive income generation.

Strategic Commodity Exposure

AssetFusionX provides curated investment options that offer exposure to key commodity sectors. Our strategies are designed to capture growth opportunities while mitigating risks inherent in raw material markets. We identify the most promising avenues for commodity investment, from energy to precious metals and agriculture, to align with your passive income goals.

Effortless Portfolio Integration

AssetFusionX integrates commodity investments seamlessly into your broader passive income portfolio. Our platform handles the research, selection, and management, allowing you to benefit from commodity price movements without actively trading. We make investing in these fundamental assets simple and accessible for everyone.