Crafting Your Path: Discovering Powerful Investment Strategies with AssetFusionX

Building lasting passive income requires more than just capital; it demands a well-defined strategy. Explore a spectrum of investment approaches designed to align with your financial goals, risk tolerance, and time horizon, all within the intelligent framework of AssetFusionX.

From disciplined long-term growth to income-focused portfolios, find the strategy that works for you.

Why a Defined Investment Strategy is Your Blueprint for Success

In the dynamic world of finance, simply "investing" without a coherent plan is like sailing without a map. An investment strategy provides the roadmap, guiding your decisions and ensuring your actions are aligned with your ultimate financial objectives. It helps you navigate market fluctuations, manage risk effectively, and consistently work towards building significant passive income and long-term wealth.

A well-defined strategy helps you make rational choices, resisting the temptation to react impulsively to short-term market noise. It defines *what* you invest in, *how much* you allocate, and *when* you might adjust your course. At AssetFusionX, we emphasize that the most successful investors are often those with a clear, disciplined approach tailored to their individual circumstances. Understanding and choosing the right strategy is the cornerstone of sustainable financial growth.

- Goal Alignment: Ensure your investments actively contribute to your specific financial milestones.

- Risk Management: Define your risk comfort zone and build a portfolio designed to stay within it.

- Discipline & Consistency: Foster a systematic approach, reducing emotional decisions.

- Optimized Returns: Select methods best suited to maximize your potential for growth and income.

- Adaptive Framework: Provide a structure for adjusting your portfolio as life changes or market conditions evolve.

Exploring Core Investment Strategies for Every Goal

Different financial goals and risk tolerances call for different strategies. Here, we outline some of the most common and effective investment approaches that can be implemented or understood within the AssetFusionX ecosystem.

1. Long-Term Growth & Capital Appreciation

This strategy focuses on maximizing the capital appreciation of your investments over an extended period (typically 5+ years). It often involves investing in companies or funds with strong growth potential, even if they don't pay high dividends currently. The core principles include:

- Growth Investing: Identifying companies expected to grow sales and earnings at a faster rate than the overall market. These are often in sectors like technology, biotech, or emerging industries.

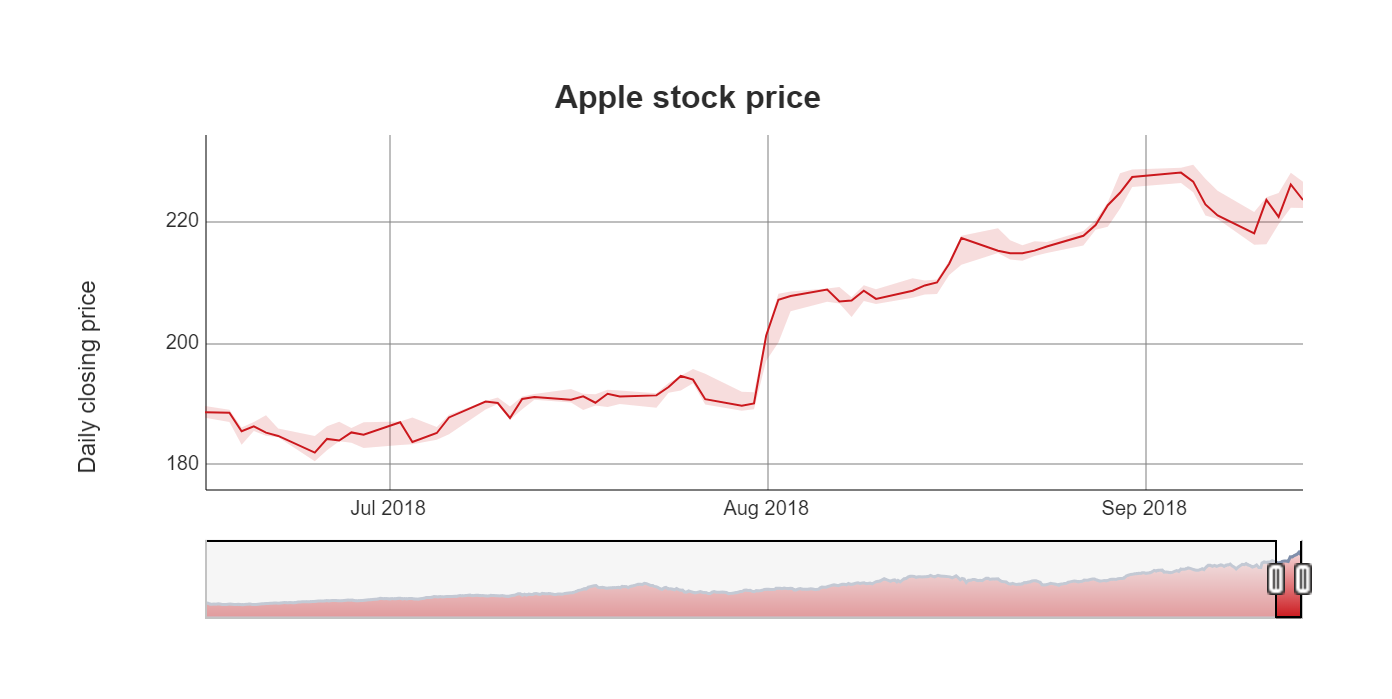

- Buy-and-Hold: Purchasing investments and holding them for many years, riding out short-term market fluctuations to benefit from long-term trends and compounding returns.

- Reinvesting Earnings: Plowing back any dividends or interest earned directly into the investment to accelerate compounding.

This approach is suitable for investors with a longer time horizon and a higher tolerance for short-term market volatility, as they are primarily seeking substantial wealth accumulation.

2. Income Generation & Passive Cash Flow

This strategy prioritizes generating regular cash flow from investments, often referred to as passive income. It's ideal for those seeking consistent payouts to supplement living expenses or to reinvest for accelerated income growth. Key components include:

- Dividend Investing: Focusing on stocks of mature, stable companies that consistently pay out a portion of their profits to shareholders.

- Bond Laddering: Investing in a series of bonds with staggered maturity dates to provide regular income streams and manage interest rate risk.

- Real Estate Investment Trusts (REITs): Investing in companies that own, operate, or finance income-producing real estate, distributing a significant portion of their income to shareholders.

- Fixed Income Securities: Investing in government or corporate bonds that pay regular interest payments.

This strategy often appeals to retirees or those looking to create a reliable stream of supplemental income, typically involving assets with lower volatility than growth stocks.

3. Value Investing: Finding Undervalued Gems

Pioneered by Benjamin Graham and popularized by Warren Buffett, value investing involves identifying and investing in assets (typically stocks) that appear to be trading for less than their intrinsic or "true" value. Value investors believe that the market can sometimes undervalue companies due to temporary bad news, misperception, or general market pessimism. They look for:

- Strong Fundamentals: Companies with solid balance sheets, consistent earnings, and competitive advantages.

- Low Price-to-Earnings (P/E) Ratios: Relative to their industry peers or historical averages.

- Undiscovered Potential: Businesses with a strong long-term outlook that the market hasn't fully recognized.

This strategy requires thorough research, patience, and a contrarian mindset, often holding investments until the market corrects their valuation.

4. Diversification & Strategic Asset Allocation

Often considered the only free lunch in investing, diversification is the practice of spreading your investments across various asset classes, industries, and geographies to reduce risk. Asset allocation is a key part of this, determining the proportion of your portfolio invested in different asset categories (e.g., stocks, bonds, cash, alternatives). The benefits include:

- Risk Reduction: Minimizing the impact of poor performance in any single investment.

- Smoother Returns: Different asset classes perform well at different times, helping to stabilize overall portfolio returns.

- Optimized Risk-Adjusted Returns: Aiming for the highest possible returns for a given level of risk.

- Strategic Rebalancing: Periodically adjusting your portfolio back to its target allocation to maintain risk profile.

This foundational strategy is crucial for passive income investors seeking stability and consistent growth over the long term, and it forms a core part of AssetFusionX's approach.

5. Dollar-Cost Averaging (DCA): The Power of Consistency

Dollar-Cost Averaging (DCA) is a strategy where you invest a fixed amount of money at regular intervals, regardless of the asset's price. This approach automatically buys more shares when prices are low and fewer shares when prices are high, potentially reducing the overall average cost per share over time. DCA is particularly effective for:

- Reducing Market Timing Risk: You don't need to predict market highs or lows.

- Disciplined Investing: Encourages regular contributions, building long-term habits.

- Mitigating Volatility: Spreads out your purchase prices, potentially smoothing out returns during volatile periods.

DCA is a fantastic strategy for passive investors who prioritize consistency and want to build wealth gradually without the stress of constant market monitoring.

Implementing Your Strategy with AssetFusionX's Intelligent Tools

At AssetFusionX, we empower you to put these strategies into action with smart, automated solutions. While we don't provide individual financial advice, our platform is engineered to facilitate effective implementation of diversified, long-term, and income-focused investment plans, making complex strategies accessible and manageable for generating passive income.

- Automated Diversification: Our portfolios are designed to be globally diversified across multiple asset classes, aligning with sound asset allocation principles.

- Effortless Dollar-Cost Averaging: Set up recurring deposits to automatically implement a consistent investment schedule, regardless of market fluctuations.

- Intelligent Rebalancing: Our system automatically rebalances your portfolio periodically to maintain your target asset allocation and risk profile.

- Access to Income-Generating Assets: We provide access to investment options that focus on consistent payouts, supporting your passive income goals.

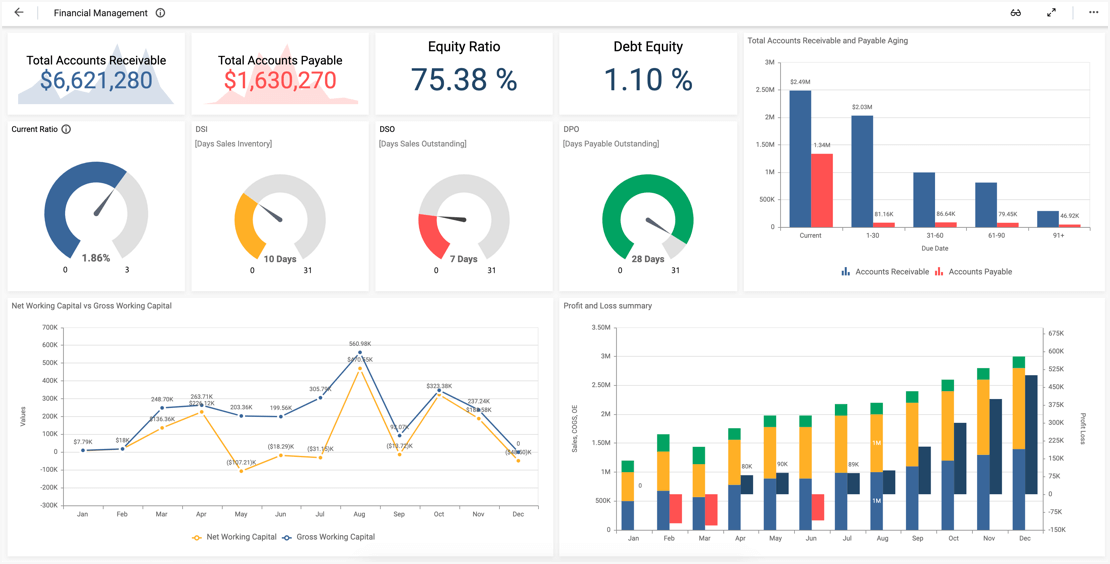

- Performance Tracking: Monitor how well your chosen strategy is performing against your goals with clear, intuitive dashboards.

We provide the framework and the tools; you provide the vision for your financial future. Let AssetFusionX be your partner in building a smart, strategic investment portfolio for sustained passive income.